Retirement in India is changing. Longer lifespans, higher healthcare costs, and shifting family patterns mean the years after work need as much planning as a career.

Retirement in India is not just an exit from the workforce. With rising life expectancy (70.8 years nationally, higher among middle class at 75-80), many retirees live nearly as long in retirement as they did working. This stage requires more than savings, it demands new purpose, health security, and social engagement.

Financial Stability and Planning

1. Secure Steady Income Sources

Fewer than 25% of Indian retirees receive a formal pension (EPFO, 2024). That makes creating steady income streams essential. The Senior Citizens’ Savings Scheme (SCSS) currently offers 8.2% annual interest, with a ₹30 lakh maximum deposit. RBI Floating Rate Bonds (7.35%+) and the Post Office Monthly Income Scheme (6.7%) are popular for their government backing. Retirees in rural areas often still prefer post offices because of accessibility and trust, while urban retirees mix annuities, dividends, and systematic withdrawal plans (SWPs) from mutual funds.

2. Optimize Tax Benefits for Seniors

Tax relief helps stretch retirement income. Senior citizens (60+) get a higher exemption limit of ₹3 lakh, while super-seniors (80+) get ₹5 lakh. Section 80TTB allows deduction of up to ₹50,000 on bank deposit interest, a big help for FD-heavy portfolios. Health insurance premiums can be claimed under Section 80D (up to ₹50,000). Many retirees miss these benefits simply due to lack of awareness or filing assistance.

3. Maintain an Emergency Fund

Medical bills and sudden repairs can derail finances. Keeping 6-12 months’ expenses in liquid mutual funds or sweep-in fixed deposits ensures fast access. Gold is a cultural favorite, but it shouldn’t be the only emergency asset since it isn’t liquid at short notice.

4. Manage Debt Before Retirement

Average home loan EMIs in metros now touch ₹40,000/month, unsustainable for fixed incomes. Clearing loans before retirement or restructuring into smaller EMIs is crucial. A debt-free start to retirement gives far more flexibility for healthcare, travel, and family support.

Healthcare and Well-Being

5. Invest in Health Insurance and Preventive Care

Medical inflation in India runs at 10-12% annually. Senior citizen health plans now cost between ₹25,000-₹40,000 per year, but they are vital. Some policies now include AYUSH (Ayurveda, Yoga, Unani, Siddha, Homeopathy) coverage, which appeals to retirees who blend traditional and modern care. Preventive checkups every year, especially for diabetes, blood pressure, and cancer screening, reduce long-term costs.

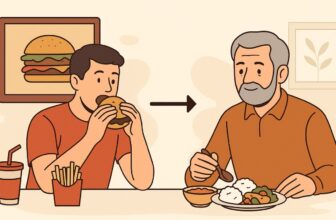

6. Adopt a Balanced Lifestyle Routine

India’s government has been promoting millets (“Shree Anna”) as a healthier alternative to rice and wheat. Retirees adopting a millet-rich diet, combined with daily yoga and morning walks, report better energy and controlled sugar levels. Community yoga parks and laughter clubs in Indian metros are particularly popular among seniors.

7. Stay Mentally Active

Cognitive decline is preventable with activity. Many Indian retirees take up online courses via SWAYAM or NPTEL, or join local library clubs. Some NGOs run 60+ digital literacy workshops in metros, teaching seniors to use WhatsApp, Zoom, or Google Pay confidently.

8. Plan for Long-Term Care

Indian families traditionally took care of elders, but nuclear families make long-term planning important. Assisted living communities in Coimbatore, Pune, and Bengaluru are rising in demand. Home healthcare agencies like Portea or Apollo HomeCare also provide regular nurse visits, physiotherapy, and monitoring devices.

Social Connection and Family

9. Strengthen Family Bonds

ICRIER research (2024) found retirees spend nearly 20% of their savings on grandchildren’s education. Emotional satisfaction also comes from rituals: shared pujas, temple visits, or simply weekly meals together. These bonds reduce loneliness and reinforce your place in the family.

10. Build a Social Circle Beyond Family

India now has over 15,000 senior citizen clubs (HelpAge India). These offer yoga, bhajans, indoor games, and festivals. RWAs in metros often arrange trips and health camps. Building these circles ensures retirees don’t become socially isolated when family members move abroad.

11. Contribute to Society

Retirees’ experience is a national asset. NGOs like Teach India use retired teachers to mentor underprivileged children, while Rotary and Dignity Foundation provide volunteering channels. Contribution beyond family builds purpose and a legacy.

Personal Growth and Leisure

12. Pursue Long-Delayed Hobbies

Retirement frees time for passions long postponed, whether it’s Hindustani classical music, memoir writing, or gardening. Many Indian retirees now publish self-written books or YouTube cooking channels. Such hobbies require little investment but bring fulfillment.

13. Explore Travel Options Within India

IRCTC offers Bharat Darshan trains that cost as little as ₹10,000 for multi-city religious circuits. Indian Railways gives 40% concession for men above 60, 50% for women above 58. Religious yatras like Char Dham or Rameswaram remain popular, but leisure trips to places like Mysuru, Kochi, or Darjeeling are also rising among retirees with disposable income.

14. Engage in Light Entrepreneurship

The “silver start-up” movement is picking up in India. Retirees run homestays in Kerala, sell crafts on Amazon Karigar, or offer consultancy in their old professions. Tiffin services and tuition classes are also common in Tier-2 cities. These ventures generate extra income without full-time stress.

15. Continue Lifelong Learning

Coursera, Udemy, and SWAYAM offer free or low-cost courses, and some Indian universities allow seniors to audit classes. Digital literacy is particularly empowering, from using UPI for payments to browsing online health services, and prevents dependence on others.

Lifestyle Adjustments for Comfort

16. Downsize or Relocate if Needed

Many retirees are moving from crowded metros to quieter, affordable cities like Coimbatore, Mysuru, or Dehradun. Retirement communities provide housekeeping, meals, and medical support, though at higher costs. Downsizing to a smaller flat also reduces upkeep, freeing funds for leisure.

17. Simplify Daily Living with Technology

With UPI processing over 14 billion monthly transactions in 2025, digital payments are nearly universal. Retirees can pay bills without standing in queues. Apps like Apollo 24/7 provide telemedicine, while BigBasket and Zepto deliver groceries. Regular video calls bridge distance with children abroad.

18. Protect Against Fraud and Exploitation

RBI data shows 13% of reported UPI fraud in 2024 involved seniors. Fraudsters target retirees with fake loan offers, lottery scams, or false property claims. Drafting a registered will (₹3-5k cost), updating nominations, and giving power of attorney to a trusted family member reduces risks.

19. Leave a Legacy and Plan Succession

Estate planning prevents disputes. A registered will ensures smooth asset transfer. Some retirees also create charitable trusts, sponsor scholarships, or donate to temples. These steps give peace of mind and ensure your wealth benefits the next generation or causes you care about.

Summary – Plan and Enjoy Retirement in India

| # | Planning | India Figures |

|---|---|---|

| 1 | Secure steady income | SCSS @ 8.2% (max ₹30 lakh), RBI Floating Rate Bonds (7.35%+), Post Office MIS (6.7%) |

| 2 | Optimize tax breaks | Higher exemption: ₹3L (60+), ₹5L (80+); Sec 80TTB: ₹50k FD/SB interest deduction |

| 3 | Keep emergency fund | 6-12 months’ expenses; liquid MF or sweep-in FD; avoid gold-only savings |

| 4 | Clear debt early | EMIs eat retirement cashflow; avg home loan EMI in metros = ₹40k/month |

| 5 | Health insurance | Senior plans ₹25-40k/year premium; AYUSH & domiciliary coverage growing |

| 6 | Healthy lifestyle | Yoga, pranayama, millet-based diet (govt pushing millets as “Shree Anna”) |

| 7 | Mental activity | Online courses (SWAYAM, NPTEL), 60+ literacy programs in metros |

| 8 | Long-term care | Assisted living hubs in Pune, Coimbatore; homecare agencies like Portea |

| 9 | Family bonds | Retirees spend avg 20% savings on grandchildren’s education (ICRIER, 2024) |

| 10 | Social circles | 15,000+ senior clubs in India (HelpAge India); RWAs run bhajan/yoga groups |

| 11 | Volunteer work | NGOs: Teach India, Dignity Foundation, Rotary senior programs |

| 12 | Hobbies | Gardening, Carnatic music, memoir writing – low-cost fulfillment |

| 13 | Travel | Railways 40% discount (men 60+), 50% (women 58+); IRCTC Bharat Darshan tours |

| 14 | Light entrepreneurship | Silver start-ups: homestays, tuition, handicrafts; low entry cost |

| 15 | Lifelong learning | Coursera/Udemy, SWAYAM free courses; some state universities allow senior audit |

| 16 | Downsize/relocate | Popular retiree hubs: Mysuru, Coimbatore, Dehradun (lower living cost) |

| 17 | Use tech daily | UPI (14B txns/month in 2025), telemedicine (Practo, Apollo 24/7), BigBasket |

| 18 | Protect against fraud | 13% of UPI fraud cases involve 60+ (RBI 2024); draft will & register property |

| 19 | Legacy planning | Registered will costs ~₹3-5k; charitable trusts and donations tax-deductible |

Retirement is not a pause, but a redirection of your life’s energy. In India, where only a fraction of people have formal pensions, careful planning becomes essential. Combining reliable income sources like SCSS or RBI bonds with health insurance, digital literacy, and secure family arrangements ensures peace of mind. At the same time, travel concessions, community clubs, and volunteering channels open doors to new experiences.

By securing finances, investing in health, and staying socially engaged, you give yourself not just comfort, but purpose. Retirement in India can be a long and rewarding chapter, one where you finally get to shape life on your own terms.